- Published on

Overview of the Dutch Housing Market in 2024

Overview of the Dutch Housing Market in 2024

Introduction

The Dutch housing market has been a topic of considerable interest and activity over the past few decades. Known for its dynamic and resilient nature, the market has seen significant growth, particularly in the 2010s, driven by various economic and policy factors. Whether you're an expat settling in a beautiful Dutch city or a local making a long-term investment, understanding current market trends and influencing factors is crucial. Staying informed about the housing market can help you make better decisions and anticipate future trends.

This article will explore the critical aspects of the Dutch housing market in 2024. We’ll start with an overview of the historical trends and growth, then dive into the factors that have shaped the market, including government policies, economic conditions, and demographic changes. We’ll also examine the current trends and statistics, highlighting regional variations and price differences across major cities and smaller towns. Additionally, we’ll discuss the different housing types available in the Netherlands, each offering unique benefits and challenges.

By the end of this article, you’ll have a comprehensive understanding of the Dutch housing market, equipping you with the knowledge needed to navigate this competitive landscape.

For those seeking more in-depth information and practical tools, my book “Guide to Buying a House in the Netherlands” provides detailed insights, resources, and guidance to help you every step.

Overview of the Dutch Real Estate Market

The Dutch real estate market has grown significantly over the past few decades, with a notable increase in the 2010s. This growth has been driven by several factors, including the government’s decision to set very low mortgage interest rates following the 2008 economic crisis. At times, these rates were close to 0%, making homeownership more accessible by allowing buyers to finance 100% of the house price with a mortgage. This financial strategy spurred home purchases and stimulated the broader economy by encouraging consumer spending and investment in housing development.

Immigration trends have also played a crucial role in this growth. The Netherlands has become a popular destination for expats, drawn by its high quality of life, robust job market, and vibrant cultural scene. This influx has increased demand for housing, particularly in major cities like Amsterdam, Rotterdam, and The Hague, where job opportunities and amenities are abundant. The COVID-19 pandemic exacerbated the housing shortage, further straining the market as lockdowns and remote work increased the desire for larger living spaces.

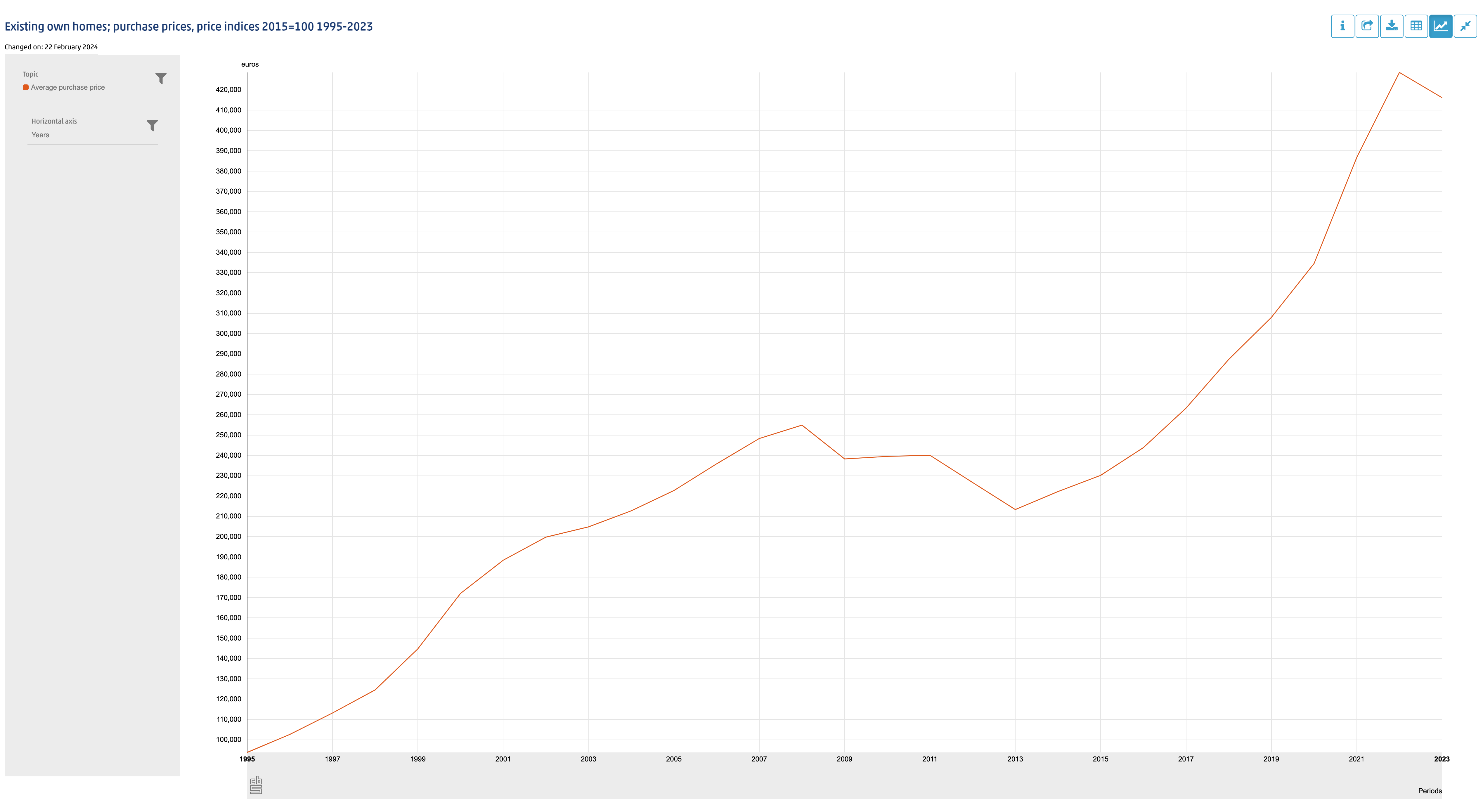

This graph shows the trends since 1995. You might notice that housing prices have doubled twice in the last two decades:

Source: cbs.nl

Despite concerns about market instability, the Netherlands remains one of the best countries in Europe in terms of Mortgage or House Price to Income ratio. This, combined with relatively simple mortgage practices and a transparent real estate system, creates an attractive environment for homeowners. As a result, both local and international buyers continue to view the Dutch property market as a stable and lucrative investment.

Factors Influencing the Dutch Housing Market

Several factors contribute to the dynamics of the Dutch housing market, including interest rates, economic conditions, and government policies. Understanding these can help you make informed decisions and anticipate future trends, such as shifts in housing demand, price fluctuations, and the emergence of new residential hotspots.

Government Policies

The Dutch government has played a significant role in shaping the housing market. After the 2008 economic crisis, the government introduced a series of proactive policies to stimulate the housing market’s recovery.

One of the most impactful measures was the reduction of mortgage interest rates to historically low levels, at times nearing 0%. This unprecedented move made homeownership more accessible and affordable, encouraging more people to buy homes and stimulating market activity.

On this graph, you can see that interest rates dropped significantly starting in 2008. Rates continued to decline over the years, reaching near-zero all-time low levels by the end of 2021, partly due to efforts to stimulate the economy amid the COVID-19 pandemic.

Source: tradingeconomics.com

Additionally, the government allows buyers to finance 100% of the house price with a mortgage, effectively reducing the barrier of a large down payment. This policy has been particularly beneficial for first-time buyers and expats who may not have substantial savings.

Moreover, these measures have helped stabilise the housing market, fostering a more resilient economy and promoting long-term financial security for homeowners. The combination of low mortgage rates and full financing options has created a more inclusive and dynamic housing market in the Netherlands.

Economic Conditions

The overall economic health of the Netherlands significantly impacts the housing market. The country has a robust and stable economy with impressively low unemployment rates, which in turn boosts consumer confidence and purchasing power. High-income levels coupled with favorable employment conditions make it easier for individuals to qualify for mortgages and sustain homeownership.

Additionally, the Netherlands’ strategic location within Europe and its strong international trade connections further enhance economic stability. This, in turn, is reflected in the housing market, where demand often outpaces supply, leading to a dynamic and competitive real estate environment.

Immigration and Population Growth

The Netherlands is an attractive destination for expats due to its high quality of life, excellent infrastructure, and robust economy. Known for its picturesque canals, vibrant cultural scene, and progressive policies, the country offers a welcoming environment for international professionals.

This influx of expats has increased the demand for housing, particularly in major cities like Amsterdam, Rotterdam, and The Hague. These urban centers, renowned for their historical charm and modern amenities, have become hotspots for foreign talent.

However, the housing shortage has been exacerbated by the growing population, which has outpaced the supply of new housing units. The challenge is further intensified by the limited availability of land and stringent building regulations, complicating efforts to expand housing stock. Consequently, rental prices have surged, making it increasingly competitive and costly to secure accommodation. Despite these challenges, the Netherlands continues to be a sought-after destination for those seeking a blend of professional opportunities and a high standard of living.

COVID-19 Pandemic

The COVID-19 pandemic had a significant impact on the housing market. Initially, the pandemic caused uncertainty and slowed down market activity, as lockdowns and health concerns kept buyers and sellers at bay. However, it soon led to a surge in demand as people sought more spacious homes due to increased time spent at home, remote work, and the need for home offices. The shift to remote work allowed many to relocate from urban centers to suburban or rural areas, further intensifying demand.

The pandemic also disrupted supply chains and construction projects, contributing to the housing shortage. Labor shortages, delays in obtaining materials, and increased costs for lumber and other building supplies exacerbated the situation. This confluence of factors led to skyrocketing home prices and fierce competition among buyers, reshaping the housing market in ways that continue to reverberate.

Housing Shortages

The Netherlands has been grappling with a housing shortage for several years. The demand for housing far exceeds the supply, particularly in urban areas where the population continues to grow rapidly. This shortage has driven up prices and made the market highly competitive, forcing many to reconsider their living arrangements. Prospective buyers often face intense bidding wars and need to act quickly to secure properties, sometimes even within hours of a listing going live.

Additionally, the shortage has led to increased rental prices, making it difficult for students, young professionals, and low-income families to find affordable accommodation. The government and developers are under pressure to implement innovative solutions to address this crisis and provide sustainable, long-term housing options.

Interest Rates and Financing

Interest rates play a crucial role in the housing market. Low interest rates reduce the cost of borrowing, making mortgages more affordable for a broader range of prospective buyers. This, in turn, can drive up demand and, consequently, home prices. However, interest rates are subject to change based on economic conditions, inflation, and central bank policies aimed at maintaining economic stability.

In 2023, mortgage interest rates were raised to nearly 4%, causing a temporary cooling of the market as potential buyers grappled with higher monthly payments. This increase was a response to inflationary pressures and was intended to curb excessive borrowing and spending. As rates stabilized and the economy adjusted, the market began to heat up again in 2024, with more buyers returning to the market and sellers adjusting their expectations.

The dynamic interplay between interest rates and market activity underscores the importance of understanding broader economic trends when making housing decisions. For both buyers and investors, staying informed about these trends is essential for navigating the ever-changing landscape of the housing market.

Trends and Statistics in 2024

After a cooling period in 2023 due to increased mortgage interest rates, the Dutch housing market began to heat up again in 2024. The average house price surged by 6-7% in the first half of the year, driven by ongoing demand and limited supply, and this upward trend shows no signs of slowing down. Housing shortages remain significant, particularly in high-demand urban areas, where competition for properties is fierce.

The Randstad area continues to be the most expensive region, with Amsterdam leading the pack in both desirability and cost. Other costly cities include Amstelveen, Haarlem, and Utrecht, each known for their vibrant cultural scenes and excellent amenities.

For a better perspective, here are the average house prices and price per square meter for the 20 most populated municipalities based on 2024 Q2 statistics, highlighting the stark differences in affordability across the country and underscoring the challenges faced by prospective homeowners:

- Amsterdam: €603,173, price per m²: €7,639

- Haarlem: €523,504, price per m²: €5,249

- Haarlemmermeer (mainly Hoofddorp): €517,500, price per m²: €4,353

- Amersfoort: €469,364, price per m²: €4,307

- Utrecht: €468,629, price per m²: €5,272

- Eindhoven: €441,113, price per m²: €3,973

- The Hague: €438,677, price per m²: €4,067

- ’s-Hertogenbosch: €437,420, price per m²: €4,070

- Almere: €433,807, price per m²: €3,877

- Breda: €424,718, price per m²: €3,881

- Zwolle: €411,144, price per m²: €3,677

- Zaanstad (mainly Zaandam): €409,203, price per m²: €3,945

- Nijmegen: €405,301, price per m²: €3,984

- Apeldoorn: €391,798, price per m²: €3,412

- Rotterdam: €391,061, price per m²: €4,057

- Arnhem: €387,258, price per m²: €3,405

- Tilburg: €362,354, price per m²: €3,297

- Enschede: €325,461, price per m²: €2,829

- Groningen: €323,901, price per m²: €3,404

- Leeuwarden: €283,902, price per m²: €2,586

Regional Variations in the Dutch Housing Market

The Dutch housing market is not uniform; there are significant regional variations in house prices and demand. Understanding these regional differences is essential for prospective buyers.

Randstad Area

The Randstad is the most densely populated and economically significant area in the Netherlands, encompassing cities like Amsterdam, Rotterdam, The Hague, and Utrecht. This region has the highest house prices due to its economic opportunities, cultural attractions, and excellent infrastructure.

- Amsterdam: As the capital city and a major global hub, Amsterdam has the highest house prices in the country. The city’s vibrant culture, numerous job opportunities, and high quality of life attract both locals and expats. The average house price in Amsterdam is €603,173, with a price per square meter of €7,639.

- Utrecht: Known for its historical charm and central location, Utrecht is another highly sought-after city. The average house price in Utrecht is €468,629, with a price per square meter of €5,272.

Other Major Cities

Outside the Randstad, several other cities also have high demand and relatively high house prices.

- Eindhoven: Known as the technology and innovation hub of the Netherlands, Eindhoven attracts many professionals and expats. The average house price in Eindhoven is €441,113, with a price per square meter of €3,973.

- The Hague: As the seat of the Dutch government and home to numerous international organizations, The Hague has a significant expat population. The average house price in The Hague is €438,677, with a price per square meter of €4,067.

Smaller Cities and Towns

House prices tend to be lower in smaller cities and towns, but these areas can offer excellent quality of life and good value for money.

- Zwolle: A charming city with a rich history, Zwolle offers more affordable housing compared to the Randstad. The average house price in Zwolle is €411,144, with a price per square meter of €3,677.

- Leeuwarden: As the capital of the Friesland province, Leeuwarden is known for its cultural heritage and lower cost of living. The average house price in Leeuwarden is €283,902, with a price per square meter of €2,586.

Types of Housing in the Netherlands

There are various types of houses, but generally, each property can be categorized into one of these types:

- Apartments or Flats (Appartement): Regular apartments, sometimes with an outside area, are predominantly found in bustling urban areas, especially in cities like Rotterdam. These compact living spaces are ideal for singles, young professionals, and small families, offering convenience and proximity to amenities. Apartments are among the most affordable types of housing in the Netherlands, making them a popular choice for first-time homebuyers and renters.

- Terraced House or Row House (Tussenwoning): The quintessential Dutch dwelling, terraced houses are the backbone of residential neighborhoods. These homes share walls with neighbors on both sides, fostering a sense of community. A typical terraced house often features a cozy garden and occasionally a front yard, perfect for families seeking a balance of affordability and outdoor space.

- Corner House or End-of-Terrace (Hoekwoning or Eindwoning): Similar to a row house but situated at the end of a row, corner houses offer more privacy by sharing only one wall with neighbors. They often come with larger gardens and additional windows, providing more natural light. These homes strike a balance between the communal feel of terraced houses and the privacy of detached homes.

- Detached House (Vrijstaande woning): These stand-alone houses offer the ultimate in privacy and space, with no shared walls. Often equipped with a garden, parking garage, or driveway, detached homes are ideal for families seeking spacious living environments. However, this luxury comes at a price, as detached houses are among the most expensive in the country.

- Semi-Detached House or Double House (2-onder-1-kapwoning or Halfvrijstaande woning): These homes feature two families sharing a single wall. While more affordable than detached houses, semi-detached homes still offer considerable space and privacy. They are a popular choice for those looking to upgrade from a terraced house without the full expense of a detached home.

- Houseboat (Woonboot): A unique and charming option in the Netherlands, houseboats offer a lifestyle close to nature, floating on the canals and rivers. While fascinating to explore, houseboats present unique challenges in terms of mortgages and buying conditions, which are more complex than conventional houses.

Conclusion

The Dutch housing market offers a variety of options for potential homeowners, whether you are looking for a budget-friendly apartment or a spacious detached house. Understanding the market trends and different types of housing can help you make an informed decision.

The Dutch housing market in 2024 presents a unique landscape of opportunities and challenges. From government policies to economic conditions, several factors influence the market dynamics. Understanding these trends and regional variations is crucial for anyone looking to enter the housing market. The high demand and limited supply mean that prospective buyers need to be well-prepared and informed about current conditions.

Ready to Make Your Move?

Navigating the Dutch housing market can be complex, but you don’t have to do it alone. Equip yourself with the knowledge and tools you need to succeed by purchasing "Guide to Buying a House in the Netherlands"

This comprehensive guide will provide you with detailed insights, practical advice, and exclusive resources to make your home-buying journey smoother and more successful. Don’t miss out on the opportunity to turn your dream of owning a home in the Netherlands into a reality. Get your copy now and take the first step towards your new home!